Innovative Banking Solutions to help you achieve more.

Our latest Media Update

Frequently Asked Questions

Zambia Industrial Commercial Bank Limited (ZICB) is a local bank that is wholly owned by Zambian institutional and individual shareholders. The Bank was incorporated on the 31st of August 2017 and started operating on the 1st of August in 2018.

The shareholding structure by percentage of the Bank is as follows:

- National Pension Scheme Authority (NAPSA): 64.27%

- Industrial Development Corporation (IDC): 30.21%

- Workers Compensation Fund Control Board: 4.74%

- Mahdi Manufacturing Ltd: 0.30%

- Guardian Insurance Brokers: 0.24%

- Davies / Angela Kabuswe: 0.23%

Its main focus of ZICB is to support the growth of its customers involved in commercial and industrial activities along with players in the customers’ value chain, including their employees.

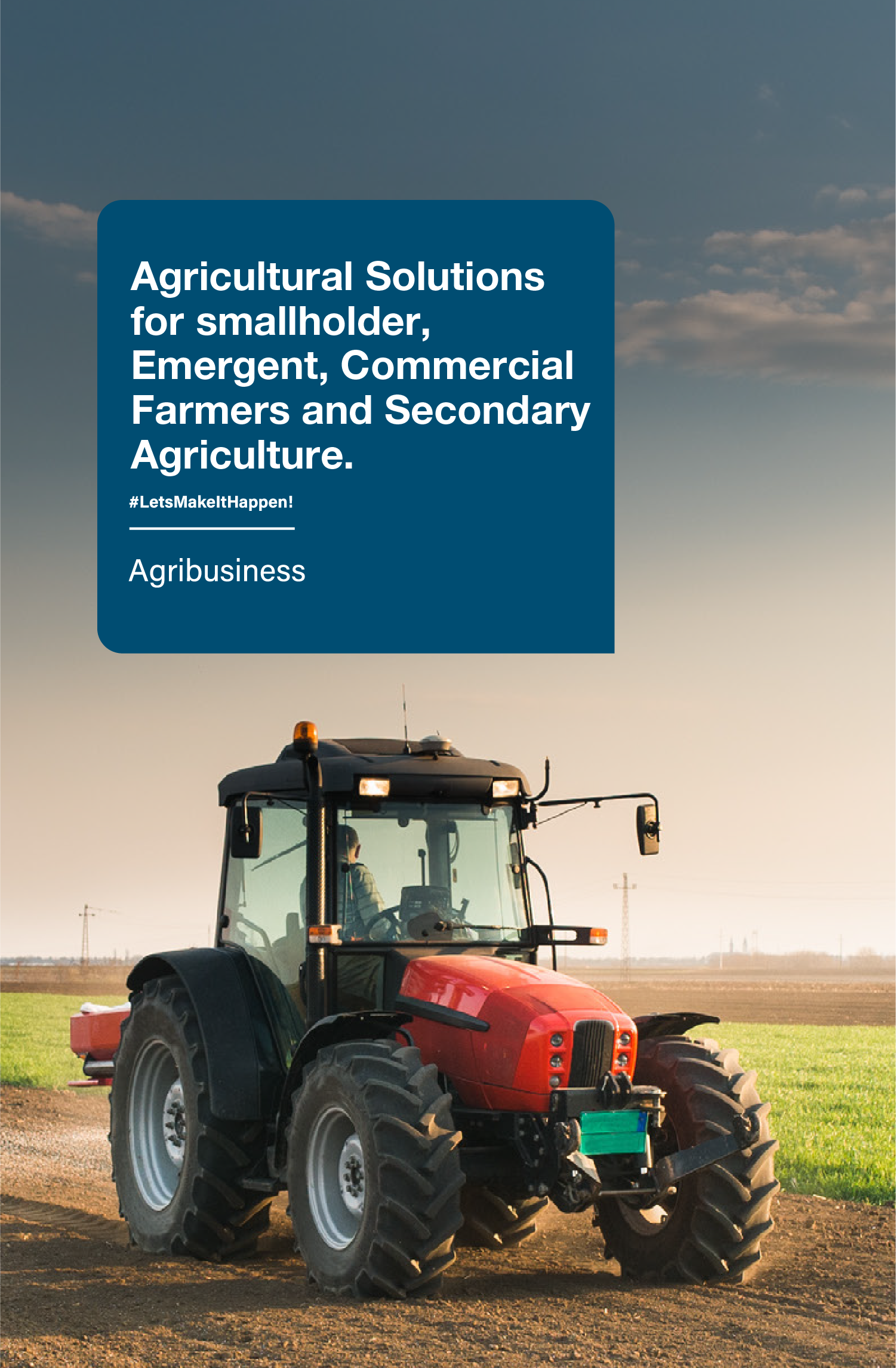

The Bank’s target market includes local corporates, MSMEs and individuals, covering the mining value chain, trading, manufacturing, agriculture, public sector, and retail sectors.

We offer full commercial banking services to both our individuals and business customers.

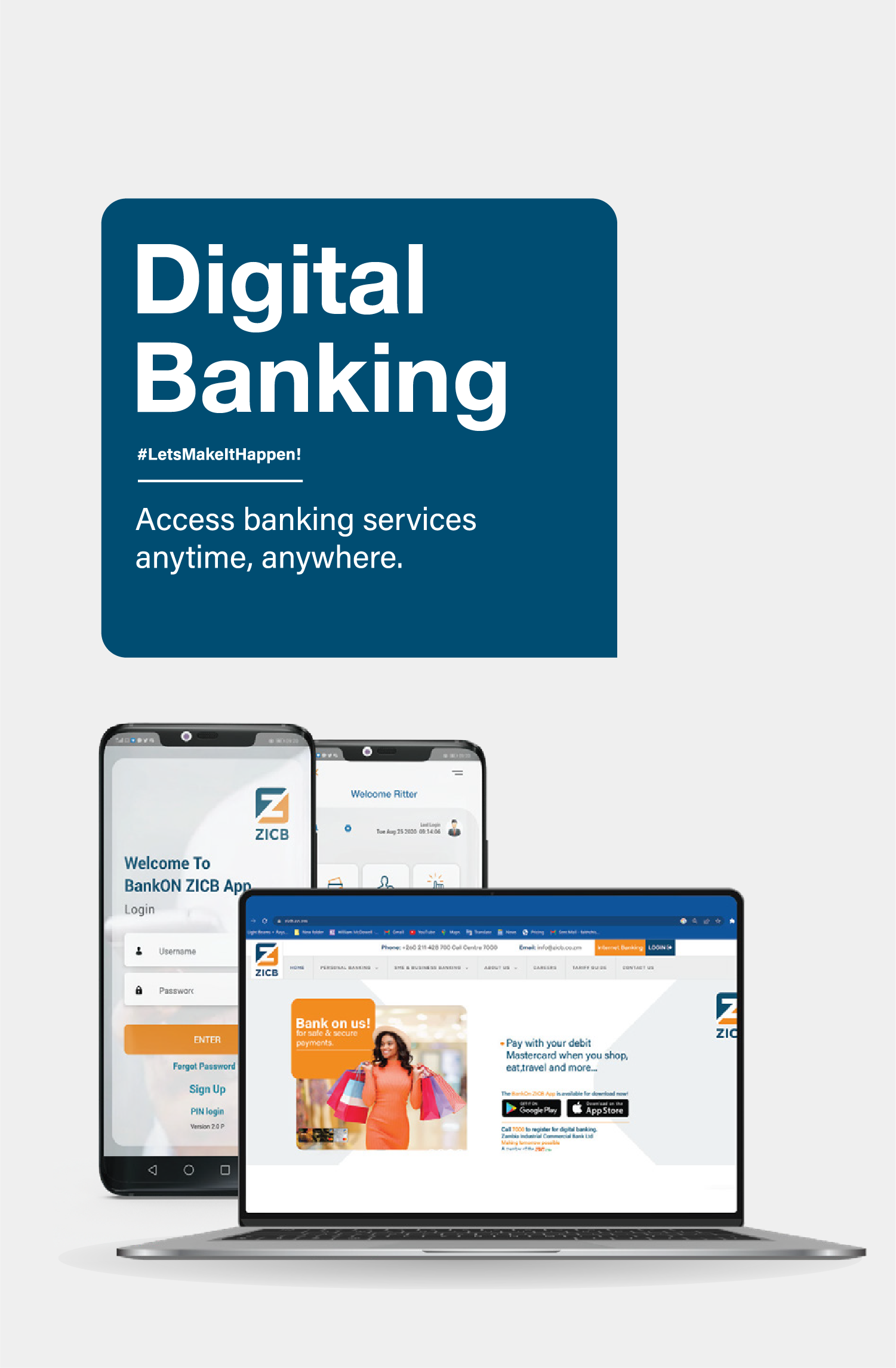

Our products and services include transactional, savings and investment accounts, online and mobile banking, as well as loan and trade finance products.

We pride ourselves to be a digital-first bank that offers banking services through digital platforms, which are complimented by physical branches and agency partnerships.

We currently operate 22 branches covering six (06) of Zambia’s 10 provinces and have partnerships with payment aggregators and MNOs. We plan to have physical representation in the remaining four (04) provinces in the short- to medium-term.

You can contact the Bank on email customerservice@zicb.co.zm or call +211 428700 / +260 760420322 / 7000 (On mobile networks). You can also find on Facebook and LinkedIn.

For more information, visit our website on www.zicb.co.zm.

Location not found!

Send us an e-mail

Our Address

Head Quarters

Email Address

Phone Number

Tel:

+26 (0) 211 227 273 /

+26 (0) 211 233 707 |

Fax:

+26 (0) 211 227 274